Описание на продукта

Параметри на продукта

Език

Английски

Параметри на продукта

Език

Английски

Описание на продукта

Състояние: Отлично

Издателство: John Wiley & Sons Inc

Град на издаване: Hoboken, New Jersey, USA

Наличност: singular

Ширина (мм): 160

Височина (мм): 235

Дебелина (мм): 22

Корици: Твърди

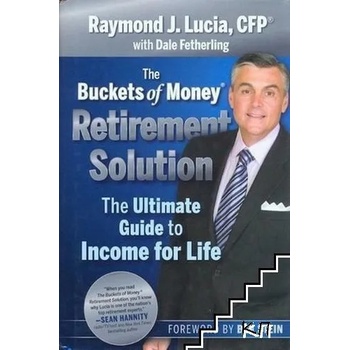

Investors, shell-shocked by the "Great Recession" of 2008-2009, are looking for answers, for something fresher than the old 'buy-and-hold' mantra. They hunger for stability, yet yearn for growth to rejuvenate their battered portfolios. Ray Lucia's The Buckets of Money Retirement Solution: The Ultimate Guide to Income for Life provides just that-a reassuring and scientifically proven strategy that gives investors both growth and income. Lucia, a Certified Financial Planner who's helped thousands of people invest more than $2 billion, explains how to spend down 'safe' buckets (containing, for example, Treasuries, CDs, bonds), while leaving a riskier bucket (real estate, stocks and alternative investments) to grow long-term. This strategy shields investors from the short-term ups and downs of the market. And it gives them the courage and discipline to stay invested no matter what the future holds. Written in a breezy, accessible style and loaded with tons of examples and clear, specific calculations, the book explains how to set your financial goals, divvy up your money accordingly, and then invest intelligently. With this book as your guide, readers will learn how to achieve both income and growth while at the same time reducing risk. "All in all, " Lucia writes, "this plan is akin to a sports car that seats six, approximating the best of both worlds. In this case by being a conservative strategy that's also growth-oriented. " Almost every kind of investment-stocks, bonds, commodities, real estate-plunged in the past year or two, turning off millions of investors who'd been planning for and counting on a reasonably comfortable retirement. These retirees or near-retirees need solutions... something fresher than the old 'buy-and-hold' mantra. Yet here's what they hear from the financial-services industry: Set up an asset-allocation model, then take a systematic withdrawal to support your retirement... remembering, of course, to rebalance the accounts to remain in sync with the model. Wrong! That maximizes the advisors' fees but doesn't protect the investors' assets during the tough times.

Издателство: John Wiley & Sons Inc

Град на издаване: Hoboken, New Jersey, USA

Наличност: singular

Ширина (мм): 160

Височина (мм): 235

Дебелина (мм): 22

Корици: Твърди

Investors, shell-shocked by the "Great Recession" of 2008-2009, are looking for answers, for something fresher than the old 'buy-and-hold' mantra. They hunger for stability, yet yearn for growth to rejuvenate their battered portfolios. Ray Lucia's The Buckets of Money Retirement Solution: The Ultimate Guide to Income for Life provides just that-a reassuring and scientifically proven strategy that gives investors both growth and income. Lucia, a Certified Financial Planner who's helped thousands of people invest more than $2 billion, explains how to spend down 'safe' buckets (containing, for example, Treasuries, CDs, bonds), while leaving a riskier bucket (real estate, stocks and alternative investments) to grow long-term. This strategy shields investors from the short-term ups and downs of the market. And it gives them the courage and discipline to stay invested no matter what the future holds. Written in a breezy, accessible style and loaded with tons of examples and clear, specific calculations, the book explains how to set your financial goals, divvy up your money accordingly, and then invest intelligently. With this book as your guide, readers will learn how to achieve both income and growth while at the same time reducing risk. "All in all, " Lucia writes, "this plan is akin to a sports car that seats six, approximating the best of both worlds. In this case by being a conservative strategy that's also growth-oriented. " Almost every kind of investment-stocks, bonds, commodities, real estate-plunged in the past year or two, turning off millions of investors who'd been planning for and counting on a reasonably comfortable retirement. These retirees or near-retirees need solutions... something fresher than the old 'buy-and-hold' mantra. Yet here's what they hear from the financial-services industry: Set up an asset-allocation model, then take a systematic withdrawal to support your retirement... remembering, of course, to rebalance the accounts to remain in sync with the model. Wrong! That maximizes the advisors' fees but doesn't protect the investors' assets during the tough times.

Липсва или е неправилен важен параметър? Предоставената информация е само за ориентиране, затова ви съветваме да проверите дали предлаганият продукт има ключовите параметри от които се нуждаете, преди да купите от магазина по ваш избор. Въпреки че се стремим към максимална точност на информацията, за съжаление не можем винаги да гарантираме 100% съответствие. Цените на продуктите са с включен ДДС.

Продуктът все още няма отзиви.